Understanding the options for Buy-to-Let Mortgages for Non-UK Residents can help you make informed decisions.

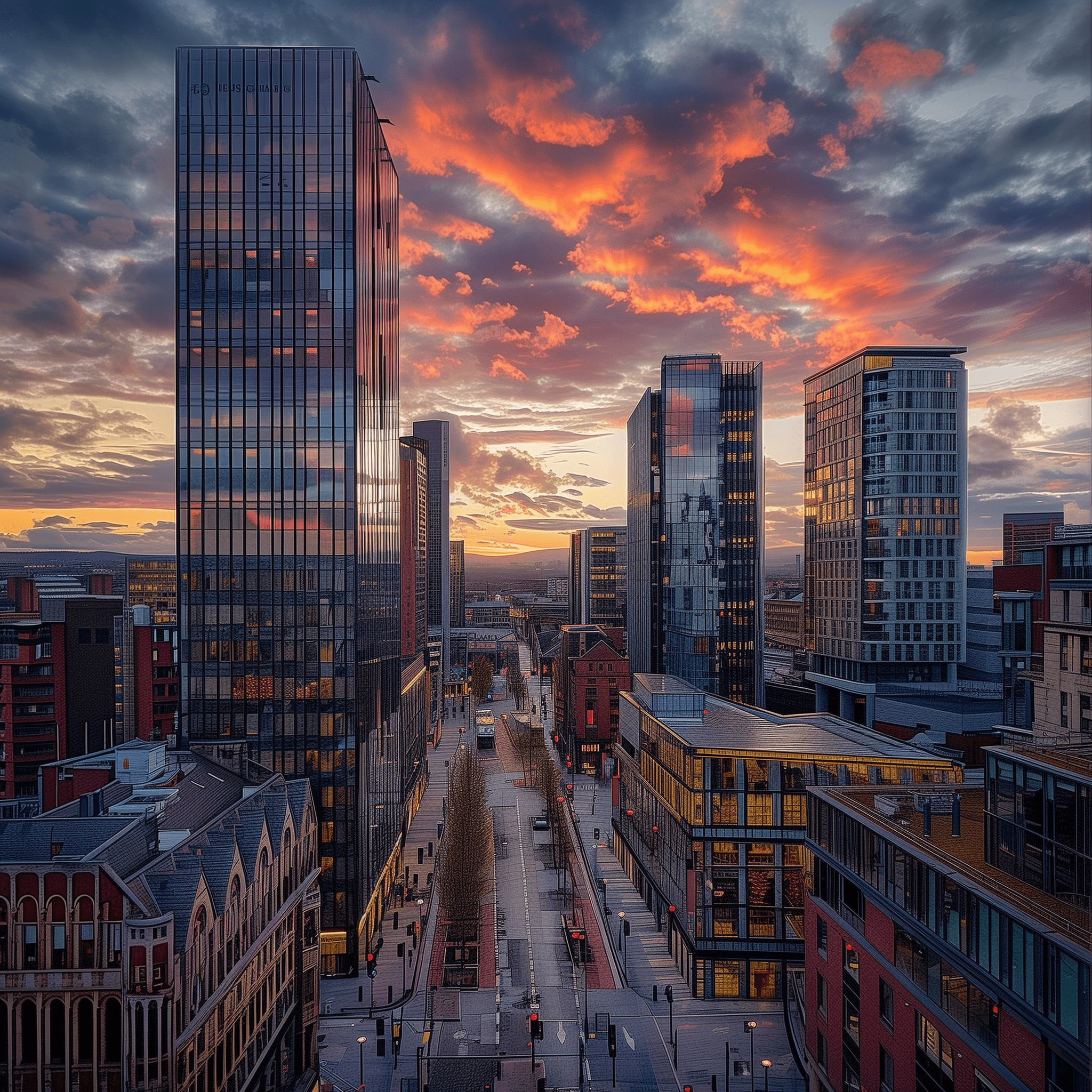

If you’re a British expat working abroad or a foreign national investor, the UK buy-to-let property market may look like an attractive option. Rental demand is strong, yields in regional cities are healthy, and property remains a long-term wealth builder.

But here’s the catch: non-UK resident buy-to-let mortgages aren’t always straightforward. High street banks rarely accommodate them, leaving many would-be landlords scratching their heads.

Understanding the intricacies of Buy-to-Let Mortgages for Non-UK Residents is crucial for successful investment in the UK property market.

The good news? Specialist lenders and brokers can make it happen. Let’s break down the rules, the pitfalls, and the opportunities—plain English, no jargon.

What Is a Non-UK Resident Buy-to-Let Mortgage?

A non-UK resident buy-to-let mortgage is a loan designed for individuals living outside the UK who wish to purchase a UK property to rent out.

You might be:

-

A British expat in Dubai, Singapore, or Hong Kong, keen to keep a foothold in the UK market.

-

A foreign national looking to diversify investments with UK rental property.

And no, you don’t have to be British or have lived here for three years. That’s a common misconception. While resident mortgages are cheaper, expats and overseas buyers can still qualify for buy-to-let finance.

Understanding Buy-to-Let Mortgages for Non-UK Residents

Yes. The UK allows both expats and overseas nationals to purchase property. There are no blanket restrictions.

The sticking point is funding. Cash buyers avoid the hassle, but most investors will need a mortgage.

-

High street lenders: prefer simple, standard cases—usually UK residents with PAYE income.

-

Specialist lenders: more flexible, able to work with overseas income, multiple assets, and foreign currencies.

Eligibility Criteria for Non-Resident Buy-to-Let Mortgages

Getting approved means clearing some extra hurdles. Expect:

1. Larger Deposits

-

Standard: 25%–40% of the property’s value.

-

Sometimes: leverage other assets (pensions, investments, existing property equity).

2. Rental Income Rules

-

Lenders stress-test affordability. They’ll usually only count 75% of the projected rent.

-

If rental income falls short, some allow top slicing (using your salary or other income to plug the gap).

3. UK Ties Help

-

Having a UK bank account, credit footprint, or previous residency makes things easier.

-

But even without ties, some lenders will still consider your case.

4. Property Restrictions

-

Some lenders won’t touch ex-local authority flats, short leases, or properties in certain areas.

How Much Does a Non-UK Resident Buy-to-Let Mortgage Cost?

Here’s where reality bites. Costs are higher.

-

Interest rates: Above standard buy-to-let mortgages.

-

Arrangement fees: Often steeper, particularly with private banks.

-

Legal & valuation fees: UK solicitors are required, plus surveys.

-

Ongoing costs: Landlord insurance, maintenance, and void periods.

Tip: Build a buffer. If your property sits empty for a few months, you’ll still need to cover repayments.

Can You Get a Buy-to-Let Mortgage From Any Country?

In principle, yes, but in practice, some countries are easier.

-

Easier approvals (low difficulty): USA, Canada, Hong Kong, Singapore, UAE.

-

Moderate difficulty: Australia, Spain, Saudi Arabia.

-

Harder markets: South Africa, certain Caribbean or Middle Eastern countries.

Why the difference? Lenders look at currency stability, regulatory risks, and demand from each country.

Top Slicing: A Workaround for Expats

Most lenders judge affordability purely on rental yield. But in expensive areas like London, yields are often too low.

That’s where top slicing comes in. It allows you to use your salary or other income streams to boost affordability.

Example: If your rental covers 60% of the affordability test, you may use employment income to bridge the remaining 15%. This flexibility is crucial for expats targeting prime property markets.

Opening a UK Bank Account From Abroad

A new opportunity: some UK lenders now allow expats and foreign nationals to open a UK bank account without residency or a visa.

Benefits:

-

Simplifies mortgage payments.

-

Helps build a UK credit footprint.

-

Can improve approval odds with multiple lenders.

Availability depends on your country of residence—so check first.

Step-by-Step: How to Get a Non-Resident Buy-to-Let Mortgage

-

Clarify your goals – Are you chasing yield, capital growth, or both?

-

Get your deposit ready – 25–40% is the norm.

-

Gather documents – Proof of income, ID, and details of other assets.

-

Speak to a specialist broker – They know which lenders will actually consider your case.

-

Set up a UK bank account – If possible, it helps.

-

Apply – Expect stricter checks and stress-testing.

-

Plan for management – Hire a property manager if you’ll be abroad.

-

Budget for tax – Register with HMRC under the Non-Resident Landlord Scheme.

Tax Considerations for Non-Resident Landlords

Don’t forget tax—it can bite.

-

Rental income: taxable in the UK.

-

Capital Gains Tax: may apply on sale.

-

Non-Resident Landlord Scheme: required registration with HMRC.

Action point: speak to a UK tax advisor before applying. Poor planning could wipe out your returns.

The Bottom Line: Is It Worth It?

Non-UK resident buy-to-let mortgages are harder to secure, more expensive, and require careful planning. But they’re achievable.

Golden rules:

-

Budget for higher deposits and interest rates.

-

Use a broker with international mortgage experience.

-

Always stress-test your finances for worst-case scenarios.

-

Get legal and tax advice early.

Do it properly, and you can build a profitable foothold in the UK’s robust rental market—even from abroad.

If you need guidance, working with an experienced mortgage broker can help you navigate the process smoothly and secure the best possible deal for your circumstances. With the right guidance and preparation, that’s where The Mortgage Blog can help turn your dreams into reality. Contact us on 0333 335 6595 or message us to explore your options and get personalised advice tailored to your unique situation.