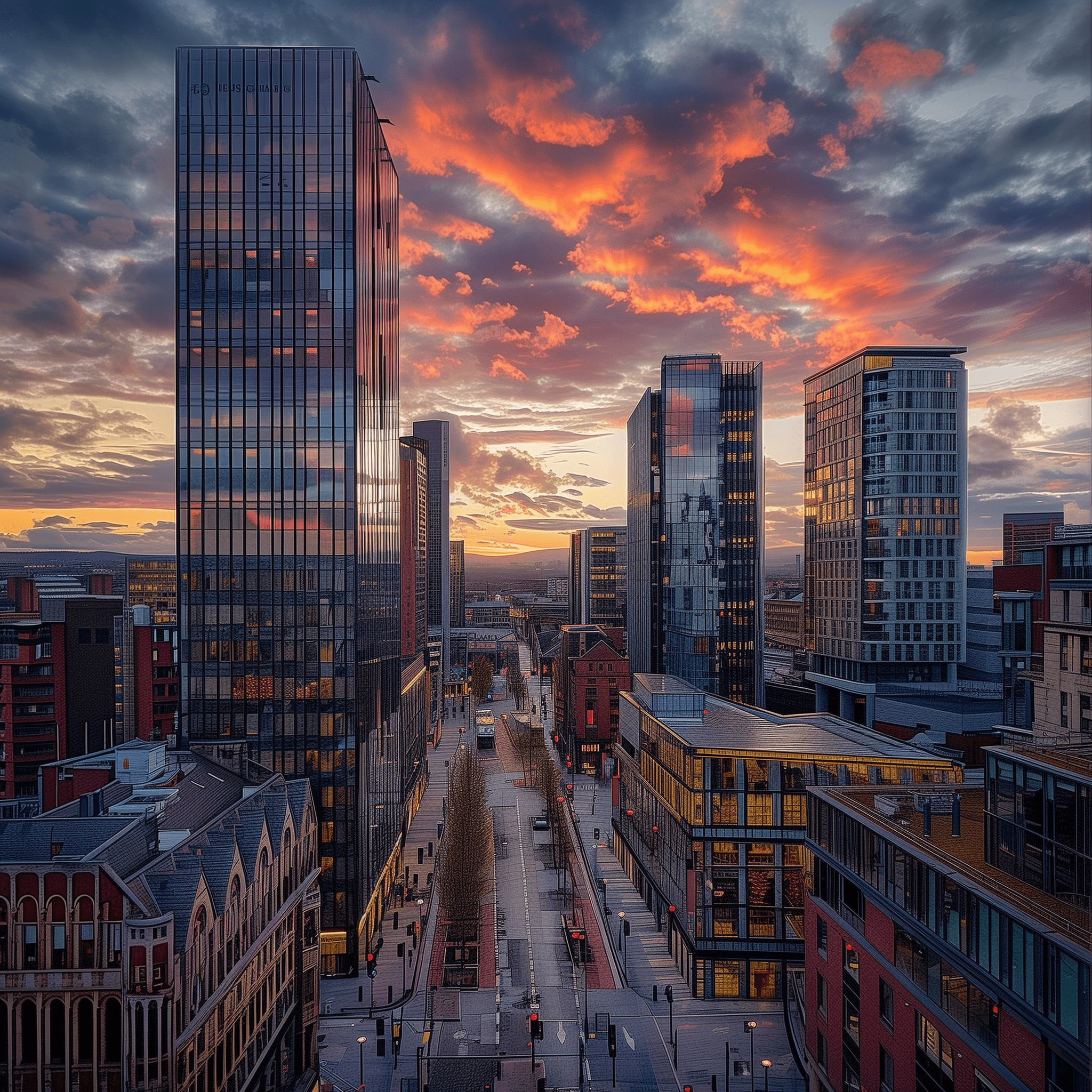

Buying UK property while living abroad sounds appealing. You may want a home for when you return, a haven for family stays, or an investment. But the expat mortgage world isn’t just “UK mortgage with slightly more paperwork.” There are risks, costs, and hurdles. Understand them, prepare properly, and you can make it work well. Miss them, and the deal may cost far more than expected.

What Exactly Is an Expat Mortgage?

An expat mortgage (or non-resident UK mortgage) is a mortgage on UK property for someone living abroad. Could be a British citizen overseas, or a foreign national living outside the UK, wanting to buy in the UK.

The property must be located in the UK, as the borrower is overseas. You’re not buying abroad; you’re buying “back home” or investing in the UK from abroad.

These are typically more complex than domestic mortgages because lenders see higher risk: foreign income, currency exposure, legal/enforcement issues, possibly no UK credit history, or long gaps away from the UK.

Why Rates, Deposits & Criteria Are Tougher for Expats

Here are the main reasons expat mortgages tend to cost more (or have stricter conditions) than “normal” UK mortgages:

- Lender risk is higher — Lenders have less visibility over your income stability, your credit history (especially UK credit history), and legal enforceability if you’re abroad.

- Currency risk — If your income is in a foreign currency, particularly one prone to volatility, lenders consider that a risk. Movements in exchange rates can affect your ability to repay in GBP.

- Deposit/LTV constraints — Loan-to-Value (LTV) tends to be lower for expats. You’ll often need to put down a bigger deposit, especially for buy-to-let.

- Lower “income multiples” or stricter income verification — Even if lenders offer high multiples of your income, they will scrutinise your type of income, how stable it is, whether it’s verifiable, whether there’s a contract, etc.

- More documentation, time, and cost — You’ll need proof of overseas income (possibly translated or audited), proof of overseas residence, and perhaps proof of overseas credit history; legal checks are often more involved.

What You’ll Typically Be Required to Do / Prove

To have a strong chance of getting a good expat mortgage, you’ll usually need:

- Stable, verifiable income. Salaried employment with long contracts is preferred. Self-employed, contractors, multi-currency or investment income are possible, but you’ll need more paperwork and possibly historical accounts.

- Significant deposit. Residential properties probably need a 20-25% deposit (or more) as an expat. Buy-to-let often demands 25-40%. The larger the deposit, the more lenders and better terms you’ll access.

- Good (or acceptable) credit history. UK credit history helps, but isn’t always essential. If you don’t have it, lenders will look at your credit history in your country of residence, other proof of financial responsibility, and strong bank account behaviour. Maintaining some financial ties to the UK (bank accounts, credit cards, etc.) helps.

- Proof of identity, address, overseas and UK. Bank statements, payslips, tax returns, contracts. If any documents are not in English or from jurisdictions unfamiliar to UK lenders, you may need certified translations or extra verification.

- Be prepared for legal / tax implications. If you’re renting out property, or using it, UK tax rules apply (income tax, stamp duty, capital gains), and also your country’s tax laws. Double taxation treaties may help, but you’ll want specialist tax advice.

How Much Can You Borrow? What Are the Terms?

Here’s what you’re likely to see in practice:

- Borrowing multiples. Many expat mortgages allow around 4-5× your annual income, though this depends heavily on your income type, stability, and how much deposit you can put down. If your income is in a more volatile or less familiar currency, you might get less.

- LTV/Deposit. Expect a deposit of around 20-25% for residential properties. For buy-to-let, more like 25-40%. If you put more down, you’ll get more options and possibly better interest rates.

- Interest rates. Higher than “resident“ rates, because lenders need to price in the extra risk. How much higher depends on your personal profile. If you check with specialist lenders or brokers, you might find competitive ones.

- Types of mortgages available. Fixed rate, tracker, variable, sometimes interest-only (especially for buy-to-let). Whether repayment or interest-only depends on your plans, how long you intend to hold the property, and whether you expect to return or let it out.

- Remortgaging. Even expats can remortgage UK property, but expect scrutiny about their income, equity, and their ability to service repayments from abroad or via UK sources.

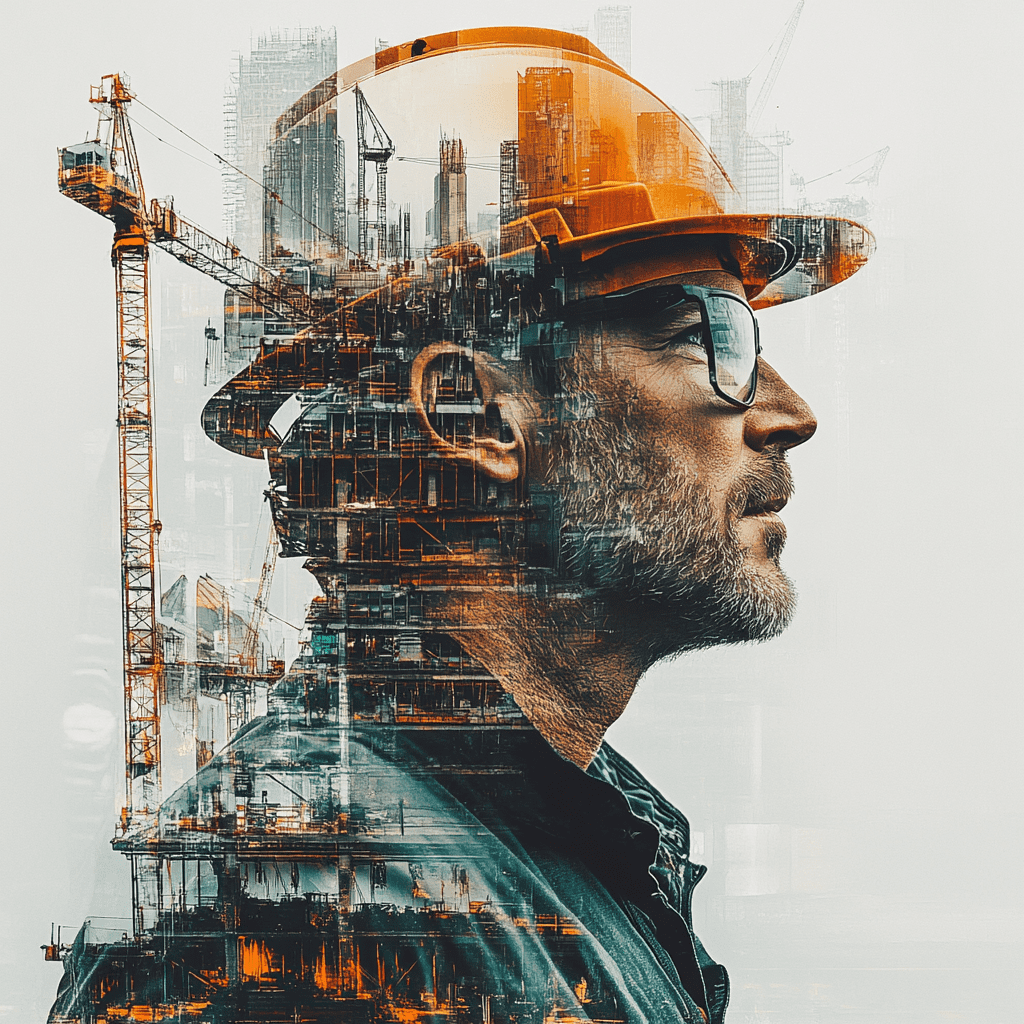

Should You Use a Specialist Broker?

Short answer: almost always, yes.

Why:

- They have access to lenders you may not find via high street or generic comparison sites. There are specialist lenders who only do expat mortgages.

- They know what documentation, what jurisdictions, what translation and verification, and what currencies lenders will accept. They can guide you through tricky bits.

- They can often negotiate or find more favourable rates or terms once you’re prepared.

- They are helpful for tax, legal, and exchange rate implications. It’s not just property cost; it’s also ongoing running, taxation, maintenance, and an exit strategy.

Practical Tips To Improve Your Chances & Reduce Costs

Here are actionable tips:

- Build or maintain a UK financial footprint — Have a UK bank account, maybe credit card(s), and keep up credit obligations.

- Save up more deposit than “minimum” — an extra deposit gives more choices, gives bargaining power, and lowers required LTV.

- Gather all documentation early — overseas income proofs, translations, address proofs, etc. The sooner this is in order, the fewer delays.

- Choose stable currencies if possible, or hedge currency risk — if any part of your earnings or savings is in volatile currencies, understand how exchange rate moves will affect your payments.

- Know the tax implications in both your country of residence and the UK — getting this wrong can cost more than a slight rate increase.

- Pick property type and location wisely — easier to sell or let is better; more desirable areas or those with high demand make the risk lower for lenders.

When It Makes Sense — And When It Doesn’t

Makes sense especially if:

- You have long-term plans to be back in the UK, or want to hold on to UK property as part of your retirement or family base.

- You want to invest in UK property rental income, and can organise property management from abroad.

- You have stable foreign income, good deposits, good documentation, and a financial buffer to cope with unexpected costs (repair, tax, vacancy).

Less ideal if:

- Your income is uncertain or in a volatile currency, with no good buffer.

- You expect very high exchange risk or large fluctuations in earnings.

- The legal/tax burden, or cost of managing property from overseas, makes it marginal rather than profitable.

- You don’t have enough deposit, or your credit/documentation is weak: you may face high rates or even rejection.

What’s Changing

- Lenders are generally more cautious about expat/non-resident applications: tighter eligibility, more documentation, reduced product availability. What was possible a few years ago might now be harder.

- On the other hand, competition among specialist expat mortgage lenders and brokers is intensifying. These pressure rates are down for well-qualified expats.

- Regulatory, economic, and tax changes (in the UK and abroad) are also influencing lenders’ risk assessments, including currency risk, overseas earnings verification, and post-Brexit changes.

- Technology is helping: digital verification, overseas record-keeping, and online application tools are making things smoother. But you still need to do your homework.

FAQ (Frequently Asked Questions)

Q: Can I get a UK mortgage if I don’t have any UK credit history?

A: Yes — but it depends. Many lenders will accept overseas credit history or other proof of financial responsibility. Having UK ties (bank accounts, credit card history, previous UK residence) helps a lot. Be ready for more documentation, perhaps a higher deposit or slightly worse rates.

Q: What deposit should I expect to pay?

A: For a residential UK property as an expat, a likely 20-25% deposit is required. For buy-to-let properties, 25-40% is more common. Sometimes more, depending on your income, debt commitments, country of residence, and how much documentation you can supply.

Q: How much can I borrow (income multiples)?

A: In many cases, expat mortgages allow around 4-5 times your annual income, but it heavily depends on the stability and type of your income, deposit size, existing debts, etc. If your income is in a weaker or volatile currency, the lender might reduce what they’ll offer.

Q: Are interest rates significantly higher for expat mortgages?

A: Yes — usually higher than the best standard residential mortgages for UK residents. How much higher depends on your personal risk profile: how strong your documentation is, the deposit, the currency of your income, and whether a specialist lender or broker is involved.

Q: Can I get a buy-to-let mortgage in the UK as an expat?

A: Yes. It’s possible. But expect stricter terms: higher deposits, interest-only options are more common, you’ll need good management arrangements (especially from abroad), and you’ll need to understand UK tax obligations (rental income tax, capital gains, stamp duty, etc.).

Q: What documents will I need?

A: Typical documents:

- Valid passport/government ID

- Proof of overseas and possibly a UK address

- Proof of income (payslips, contracts, accounts, tax returns, especially for self-employed)

- Bank statements (3-6 months or more)

- If income or documents are in non-English or from non-UK institutions: translation, certified copies, sometimes extra verification

Q: Should I wait until I’m back in the UK to apply?

A: Not necessarily. If your finances are strong, documentation is in order, and you have a solid deposit and clear plan, applying while abroad can make sense — particularly if UK property prices are rising or you want to lock in something. However, returning to the UK can simplify many aspects of the process, including credit history, lenders’ comfort, and possibly better rates and more choice.

If you need guidance, working with an experienced mortgage broker can help you navigate the process smoothly and secure the best possible deal for your circumstances. With the right advice and preparation, that’s where The Mortgage Blog can help turn your dreams into reality. Contact us on 0333 335 6595 or message us to explore your options and get personalised advice tailored to your unique situation.