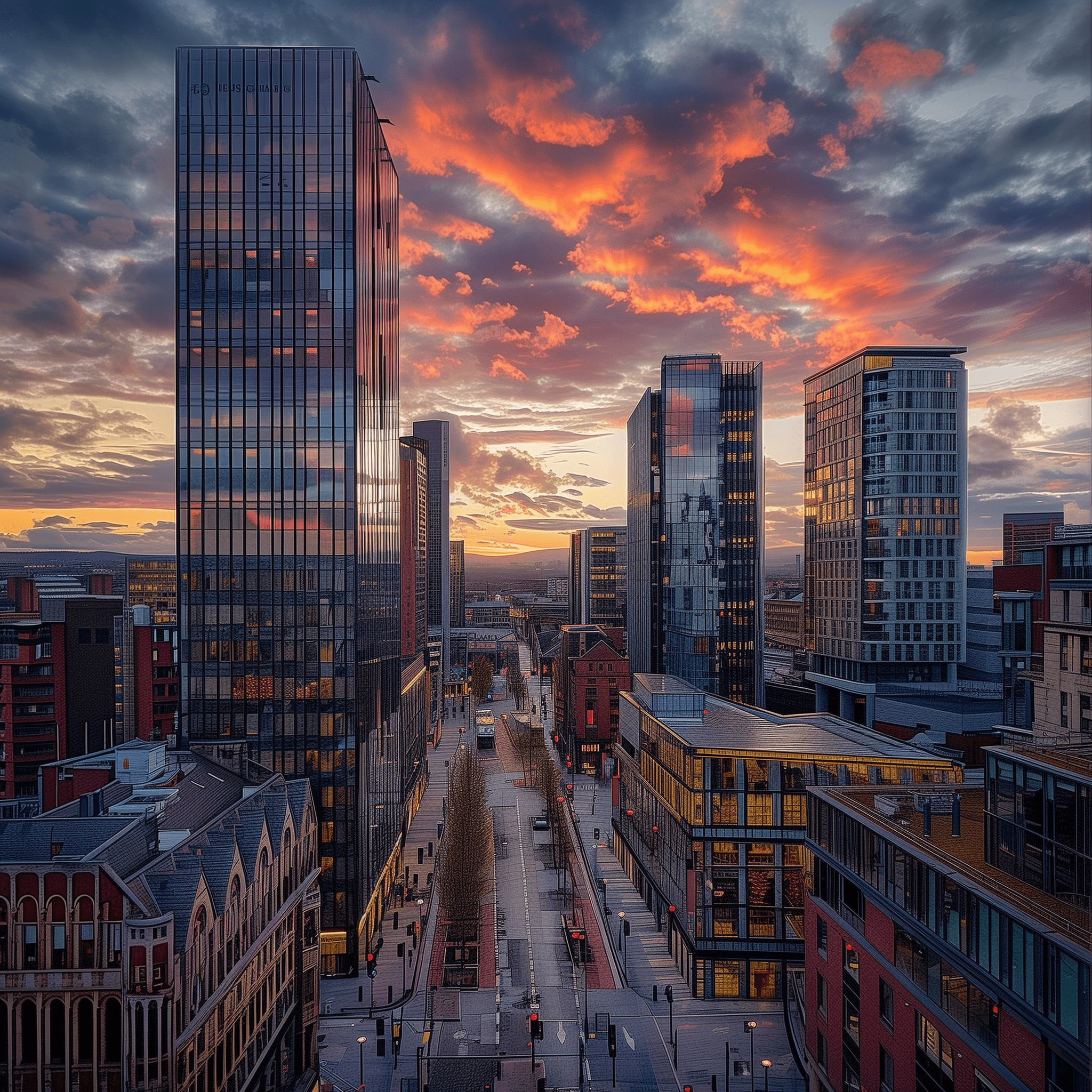

Holidays at home have boomed in the last few years. From seaside cottages in Cornwall to cosy cabins in the Lake District, many people aren’t just booking them – they’re buying them. And with that comes the question: how on earth do you finance one of these properties?

That’s where holiday let mortgages come in. But don’t confuse them with buy-to-lets. They’re a different beast entirely – with their own rules, benefits, and pitfalls. If you’re thinking of dipping your toes in, read on. I’ll walk you through the basics, the traps to avoid, and the key money-saving tips.

What is a Holiday Let Mortgage?

In plain English, it’s a mortgage designed specifically for properties you’ll rent out as short-term holiday accommodation. Unlike a standard buy-to-let (which assumes long-term tenants), lenders know these properties will have guests for a few days or weeks at a time, with gaps in between.

That means more risk for the bank – but also more income potential for you. To balance this, lenders set different criteria.

Here’s the biggie:

- You cannot use a standard residential mortgage if you plan to let out your property as a holiday home. Doing so would breach the terms and could land you in hot water.

- You cannot usually use a buy-to-let mortgage either – most buy-to-let products don’t allow short-term holiday lets.

So, if it’s a genuine holiday rental business you’re after, you need a holiday let mortgage.

Who Offers Them?

Not every bank does. In fact, compared to mainstream mortgages, the choice is limited. You’ll often find them through specialist lenders and building societies. A good broker (ideally one with holiday let experience) can save you hours of frustration here, because they’ll know which lenders are active in the space.

Some of the names that crop up include:

- Smaller regional building societies.

- Specialist lenders who cater for landlords and property investors.

- A few mainstream banks, but usually with stricter rules.

And remember, products and lenders change regularly. Always check the latest availability before making assumptions.

What Do Lenders Look For?

Here’s where it gets specific. With a holiday let mortgage, the lender typically wants to know two main things:

- Can you afford the repayments?

- Lenders will assess your income and outgoings just like they would for a standard mortgage. But they’ll also look at the property’s rental potential. Instead of calculating affordability on a 6- or 12-month tenancy, they’ll use estimates of peak and average seasonal rents. Some lenders want a letter from a holiday letting agent to confirm the likely income.

- Do you meet the criteria?

- Minimum income: Some lenders want you to earn at least £25,000 outside the rental income.

- Loan-to-value (LTV): Typically up to 75% of the property’s value, meaning you’ll need a 25% deposit. A few may go lower, but expect stricter terms.

- Property type: Not all properties are acceptable. Tiny studio flats, properties in remote areas, or those with unusual construction might be rejected.

- Personal use: Most lenders allow you to use the property yourself for a certain number of weeks each year, but there’s usually a cap (often around 90 days).

How Much Can You Borrow?

Let’s say you want to buy a cottage in Devon for £400,000. With a 25% deposit (£100,000), you’d be looking to borrow £300,000. The lender will check whether the property can generate enough rental income to cover the mortgage, usually at a stress rate of around 125–145% of the interest payments.

So, if your mortgage costs £1,000/month in interest, the lender will want to see that the property can generate at least £1,250–£1,450 per month on average over the year.

That’s why location and rental demand are critical. A two-bed flat in a sleepy village may struggle. A seaside retreat in a tourist hotspot may smash it.

Tax Rules You Need to Know

This is where things get tricky – and potentially rewarding. Holiday lets can qualify as Furnished Holiday Lets (FHLs), which have special tax treatment compared to standard rental properties.

To qualify as an FHL, your property must:

- Be available to let for at least 210 days a year.

- Be actually let for at least 105 days a year.

- Be in the UK or EEA.

- Not have any single let longer than 31 continuous days.

If you tick those boxes, here’s the good bit:

- Mortgage interest is fully deductible. Unlike standard buy-to-lets (where mortgage relief is restricted), you can offset the full interest cost against your rental income.

- Capital allowances apply. You can deduct the cost of furniture, fixtures, and equipment.

- Profit counts as earned income. That means you can make pension contributions against it, boosting your long-term savings.

- Potential capital gains tax benefits. Certain reliefs (like Business Asset Disposal Relief) may be available when you sell.

Of course, tax rules are complex and subject to change. If you’re considering this seriously, it’s worth chatting to an accountant who understands holiday lets.

The Pitfalls

It’s not all sunshine and sandy beaches. Here are the risks to watch:

- Seasonality. You may earn bumper income in July and August, but very little in January. Can you handle the cash flow ups and downs?

- Running costs. Holiday lets can be expensive to run. Cleaning, linen, utilities, marketing fees, repairs – they all eat into your profits.

- Empty weeks. No bookings = no income. Unlike a standard tenant, there’s no guarantee of rent every month.

- Local restrictions. Some councils are cracking down on short-term lets, introducing licensing schemes or planning restrictions. Always check before buying.

- Interest rates. Specialist mortgages can be pricier. Expect rates higher than standard buy-to-let or residential deals.

Is It Worth It?

The million-pound question (sometimes literally). For many, yes. A well-run holiday let in the correct location can be lucrative and give you a second home to enjoy. But go in with your eyes open: this is not passive income.

Think of it as a small business. You’ll need to manage bookings, deal with guests, arrange cleaners, keep on top of tax rules, and ensure you stay compliant with mortgage conditions.

If you treat it as a business and budget sensibly, it can work brilliantly. If you treat it like a hobby and underestimate the costs, it can become a financial drain.

Top Tips Before You Dive In

- Run the numbers twice. Be pessimistic with your income forecasts and generous with your expense estimates. If it still stacks up, you’re on firmer ground.

- Use a broker. Finding the proper holiday let mortgage for yourself can be like searching for a seashell in a haystack. A broker will know the market.

- Check local rules. Planning restrictions, licensing, and tax rules can vary wildly. Do your homework before you buy.

- Get the right insurance. Standard home insurance won’t cut it. You’ll need specialist holiday let cover.

- Think long-term. Ask yourself: if the holiday market dips, could you still cover the mortgage?

Bottom Line

Holiday let mortgages open the door to owning a property that pays for itself – and potentially earns you a tidy profit. But they come with rules, costs, and risks that you need to navigate carefully.

If you’re serious, crunch the numbers, take proper advice, and go in with your eyes wide open. Do it right, and your holiday let could be more than just a bolt-hole by the sea – it could be a smart financial move.

Reach out to our experienced advisers, and we’ll provide an overview of available options for holiday let mortgages while delving into the best-suited solution for you. Call us on 0333 335 6595 or message us to get started!

Holiday Let Mortgages: Your Questions Answered

Holiday lets have exploded in popularity, but financing one isn’t as simple as taking out a standard mortgage. Here I tackle the most common questions people ask – straight answers, no fluff.

❓ Can I use a standard mortgage for a holiday let?

No. If you’re planning to rent out your property on a short-term basis, a standard residential mortgage won’t allow it. You’d be breaking the terms, which can cause serious problems with your lender.

And don’t assume a buy-to-let mortgage works either – most of those are for long-term tenants only. What you need is a holiday let mortgage, designed for short-term rentals.

❓ Who actually offers these mortgages?

They’re not everywhere. Don’t expect your high street bank to throw deals at you. Many holiday let products come from:

- Specialist lenders

- Building societies (especially smaller regional ones)

- A handful of mainstream banks with stricter rules

A good broker is worth their weight in gold here – they’ll know which lenders are active and which ones aren’t.

❓ How much deposit will I need?

Most lenders require a 25% deposit. Some may let you borrow up to 75% loan-to-value (LTV), but don’t bank on going higher.

Example: Buy a £300,000 cottage → you’ll likely need a £75,000 deposit and borrow £225,000.

❓ How do lenders decide what I can borrow?

They look at two things:

- Your personal finances – many want to see you earn at least £25,000 from other sources (job, business, etc).

- Rental income potential – not from long-term rent, but from holiday bookings. They’ll often want an agent’s letter to estimate how much the property will bring in across peak and quiet seasons.

If the property can bring in 125–145% of your mortgage interest payments, lenders are usually happy.

❓ Can I use the property myself?

Yes – most lenders allow some personal use (often up to 90 days per year). But check carefully – overdo it, and you could breach your mortgage terms.

❓ What about tax – is it better or worse than buy-to-let?

Potentially better, if your property qualifies as a Furnished Holiday Let (FHL). To qualify, you need to:

- Make it available at least 210 days a year

- Actually, let it for at least 105 days

- Not have any single booking longer than 31 days

If you meet those rules, you get perks:

- You can deduct all mortgage interest from your rental income (unlike standard buy-to-lets, which are restricted).

- You can claim capital allowances for furniture and equipment.

- Profits count as earned income, which means you can make pension contributions against them.

- You may get extra capital gains tax relief when you sell.

That’s generous – but the rules are fiddly, so check with a tax adviser before banking on it.

❓ Sounds good – what’s the catch?

Here are the traps people often miss:

- Seasonality: Busy summers, quiet winters – your cashflow can be lumpy.

- Costs: Cleaning, linen, marketing, insurance, repairs – they add up.

- Empty weeks: No guests, no rent. Unlike buy-to-let, there’s no guaranteed income.

- Local rules: Some councils are clamping down on short-term lets. Check planning and licensing requirements before you buy.

- Mortgage rates: Holiday let deals are often pricier than standard buy-to-let or residential rates.

❓ So is a holiday let a good investment?

It can be – in the right location, with the right numbers. Think of it less as “easy money” and more as running a small business. You’ll need to manage bookings, deal with guests, keep on top of tax, and juggle finances.

Done well, you can earn a solid income and enjoy a personal holiday retreat. Poorly done, it can drain your wallet and your time.

For more details and tailored advice on arranging a holiday let mortgages, we encourage you to reach out to our knowledgeable team. Simply call our office at 0333 335 6595 or message us to speak with a member of our dedicated commercial team.