Buying a new build home is exciting. Fresh paint, modern design, energy efficiency – and you’re the very first person to live there. But if you’re looking at a mortgage for a new build, beware: the process isn’t always as straightforward as buying an older property.

This guide explains what a new build mortgage is, how lenders treat new builds, the common pitfalls, and the key tips to avoid costly mistakes.

Whether you’re a first-time buyer, upsizer, or investor, this is your no-nonsense, money-saving deep dive into new build mortgages.

What Is a New Build Mortgage?

A new build mortgage is simply a mortgage on a property that has just been built (or is still being built) and has never been lived in before.

While the mortgage itself isn’t a special “type”, lenders often apply different rules to new builds compared to older homes. Why? Because new builds can carry higher risks for lenders, including:

- Valuation risk: Like a new car, new builds can lose value as soon as you “drive them off the forecourt.”

- Delays: Construction or legal completion dates can move around.

- Incentives: Developers sometimes offer freebies (stamp duty contributions, furniture packs, deposits), which can skew valuations.

That’s why lenders tend to be more cautious with their lending criteria.

Why Are New Build Mortgages Tricky?

1. Higher Deposit Requirements

Most lenders want a larger deposit for new builds:

- Houses: Usually at least a 10% deposit.

- Flats: Often 15% or even 20%.

Compare this to second-hand homes, where 5% deposit deals are more widely available.

Tip: Always check if your chosen lender has stricter rules for new builds before you reserve a plot.

2. Mortgage Offer Expiry

A mortgage offer usually lasts 6 months. But new build completions can drag on for much longer. If your mortgage offer expires before the property is finished, you may need to reapply – and risk losing the rate you locked in.

Tip: Some lenders (e.g. Halifax, Nationwide, Barclays) will extend new build mortgage offers for up to 9–12 months. Choose one of these if your build completion date is uncertain.

3. Incentives and Valuations

Developers love to tempt buyers with incentives: “We’ll pay your stamp duty!” or “Here’s a £5,000 furniture voucher.”

Sounds great – but lenders treat these as a price discount, not a freebie. If you agree to pay £300,000 but get £10,000 in incentives, the lender may value the property at £290,000. That reduces the “loan-to-value” and can restrict your borrowing.

Tip: Stick to cash incentives (small contributions) and avoid gimmicks that muddy the waters with the valuer.

4. Leasehold and Service Charges

Many new builds – especially flats – are leasehold. That means you don’t own the land outright and must pay ground rent and service charges.

Some lenders won’t touch leasehold properties with onerous clauses (e.g. doubling ground rent every 10 years). And high service charges can eat into affordability checks.

Tip: Get your solicitor to review the lease carefully. Don’t assume the shiny new flat is “hassle-free.”

The Step-by-Step Process of Getting a New Build Mortgage

- Reservation – You put down a reservation fee (usually £500–£2,000) to secure your plot.

- Mortgage Agreement in Principle (AIP) – Speak to a broker to see what you can borrow. This helps prove to the developer you’re serious.

- Full Mortgage Application – Once you’ve reserved, you’ll apply for the mortgage.

- Valuation – The lender sends a valuer to confirm the price is realistic.

- Mortgage Offer – If approved, you get your mortgage offer (valid typically 6 months).

- Exchange Contracts – You legally commit to buy, often within 28 days of reserving.

- Build Completion – When the home is finished, you complete and move in.

Key Schemes and Support for New Build Buyers

1. Deposit Unlock

A 5% deposit scheme created by the housebuilding industry and backed by certain lenders. Available on new build homes up to £750,000 (depending on the lender).

2. First Homes Scheme

Government-backed, offering eligible first-time buyers and key workers discounts of 30–50% on new builds. But not all developers take part.

3. Shared Ownership

Buy a share (25–75%) of a new build home and pay rent on the rest. Lower upfront deposit, but remember you’ll also pay service charges.

4. Developer Incentives

Cashbacks, legal fee contributions, and stamp duty paid. Just be cautious (as explained earlier).

Common Pitfalls to Avoid

- Paying too much for the “new build premium”

New builds often sell at a premium compared to older homes. If you sell within the first 2–3 years, you might struggle to get back what you paid.

- Overstretching on extras

Developers will upsell upgrades, such as kitchens, flooring, and appliances. Costs mount quickly, and you can’t usually mortgage these extras.

- Ignoring completion delays

If your mortgage offer expires, you could end up with a higher rate (or no mortgage at all).

- Assuming incentives = free money

As mentioned, lenders treat incentives as a reduction in purchase price.

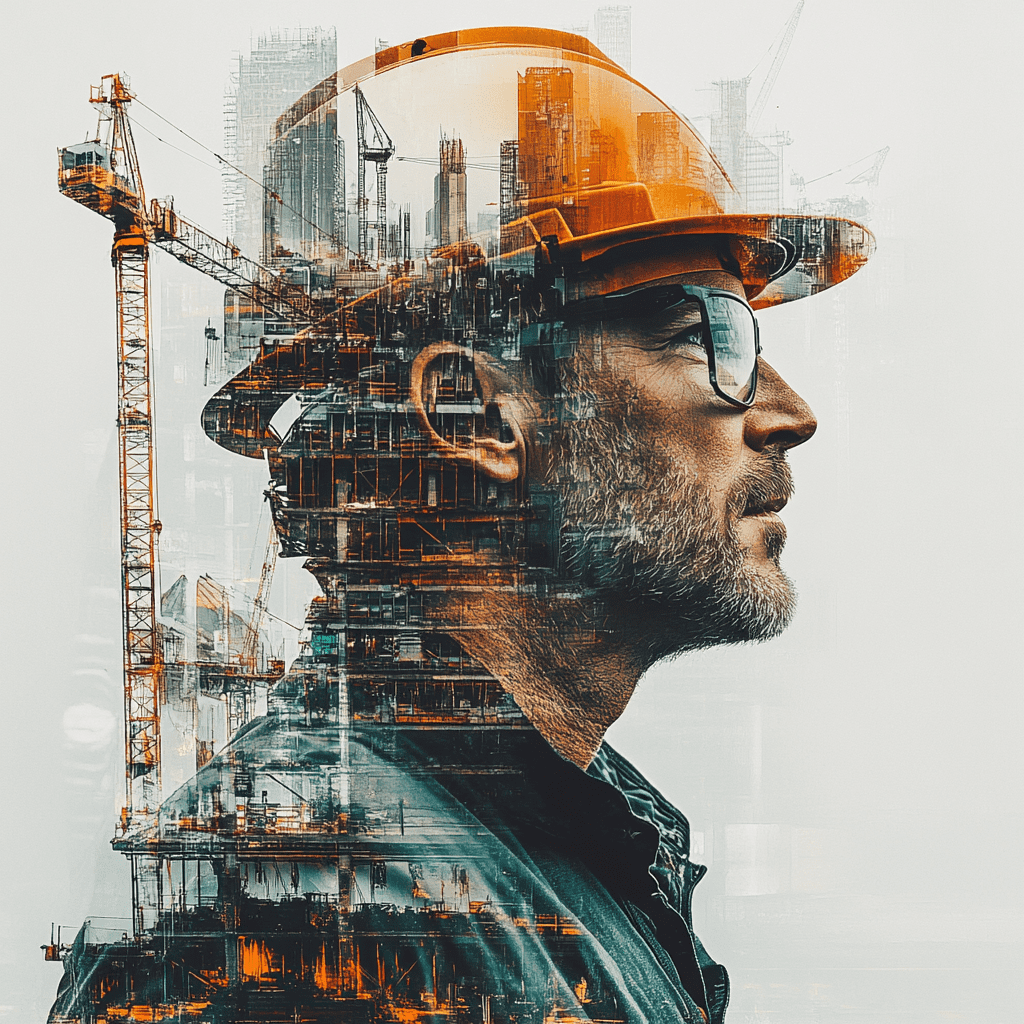

Top Tips for Success With New Build Mortgages

- Use a mortgage broker: They’ll know which lenders are flexible with new builds.

- Ask about offer extensions upfront: Don’t get caught out by expiry dates.

- Check the lease: Watch for doubling ground rent or high service charges.

- Budget beyond deposit: Factor in reservation fees, upgrades, stamp duty, and moving costs.

- Negotiate: Developers expect haggling, especially near financial year-end, when they want to hit sales targets.

New Build Mortgages FAQs

- Can I get a 95% mortgage on a new build?

Sometimes, but lenders are stricter. 95% is more common on houses than flats.

- Do I need a larger deposit for a new-build flat?

Yes. Most lenders require at least a 15% down payment.

- How long does a new build mortgage offer last?

Typically 6 months, but some lenders extend to 12 months.

- Are new builds overpriced?

Often. They carry a “new build premium.” Expect slower price growth than older homes in the first few years.

- Should I buy through Shared Ownership or Deposit Unlock?

Both can help if you’ve only got a small deposit, but weigh the long-term costs carefully.

Final Word

Buying a new build home can be brilliant – low maintenance, energy efficient, and tailored to your taste. But new build mortgages come with traps: higher deposits, tighter lender rules, and the dreaded offer expiry.

The golden rule: plan early, know the risks, and get expert advice. A good broker can save you thousands and stop your dream home from turning into a financial nightmare.

With the proper guidance and preparation, that’s where The Mortgage Blog can help turn your dreams into reality. Contact us on 0333 335 6595 or message us to explore your options and get personalised advice tailored to your unique situation.